Mini Split Tax Credit: What Homeowners Need to Know in 2025

Homeowners installing eligible ductless mini split heat pump systems in 2025 may qualify for a valuable federal tax credit under the Inflation Reduction Act. This energy efficient home improvement credit offers up to $2,000 annually for qualifying heat pump systems, including certain ENERGY STAR® certified mini splits. To be eligible, the unit must meet or exceed the Consortium for Energy Efficiency’s (CEE) highest efficiency tier. This credit supports energy-conscious investments in your home's heating and cooling system, helping reduce utility costs while improving year-round comfort. Learn more about qualifying mini splits and federal tax credits.

Find a Dealer today to see if you qualify for a tax credit.

Who Qualifies for the Federal Mini Split Tax Credit in 2025

To qualify for the mini split tax credit 2025, your ductless mini split system must meet specific efficiency standards, including the CEE’s highest tier for air source heat pumps. Only qualified heat pumps that meet ENERGY STAR guidelines are eligible. Proper documentation — such as product specs and installation receipts — must be saved to claim the credit on IRS Form 5695. The home must be a primary residence (not a business-only property), and rental units generally do not qualify unless the owner also lives in the home. Visit Carrier’s mini-split heat pumps page to explore eligible products.

Maximizing Savings: Combining Mini Split Tax Credits With Other Home Upgrades

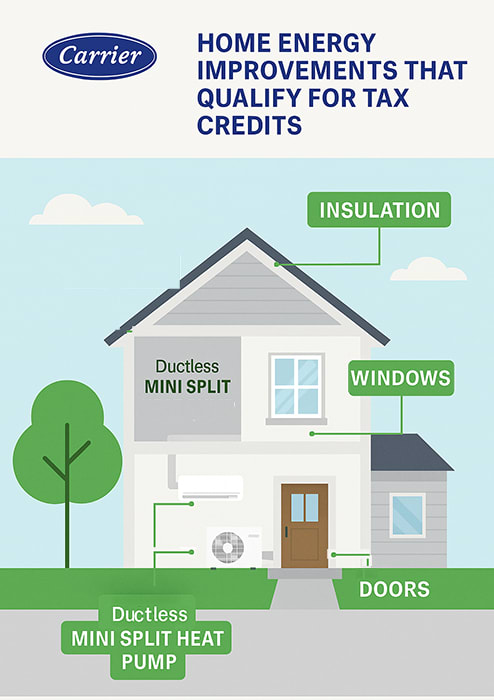

You can boost your 2025 tax return by pairing your mini split heat pump installation with other energy efficient home improvement upgrades. The IRS allows homeowners to combine improvements such as windows, insulation, and doors for a maximum annual credit of $3,200. Since mini splits are capped at $2,000 per year, you can still claim additional credits — up to $1,200 — for other qualifying upgrades in the same year. Use Form 5695 to document each improvement. For savings ideas and bundle options, explore Carrier’s energy-saving tips and product recommendations.

Common Questions About Mini Split Tax Credits

In addition to ductless mini splits, other Carrier systems may qualify for federal tax credits if they meet the CEE highest tier or ENERGY STAR criteria. This includes:

- Ducted Heat Pumps

- High-Efficiency Furnaces

- Energy-Efficient Central AC Systems

Be sure to check each product’s technical specifications and consult with a dealer to determine eligibility.

Disclaimer: The information provided herein is for informational purposes only and is not intended to be construed as legal, financial, or tax advice. You should consult your own tax advisor or other qualified professional for your specific legal, financial, or tax needs.